Routing #:. 520416310 & Swift Code: HEXEAEAA1

More Detailsservice.excellence@hecfinance.com

service.excellence@hecfinance.com

Routing #:. 520416310 & Swift Code: HEXEAEAA1

More DetailsHEC Bank is committed to fostering, promoting, and preserving a culture of diversity, equity and inclusion.

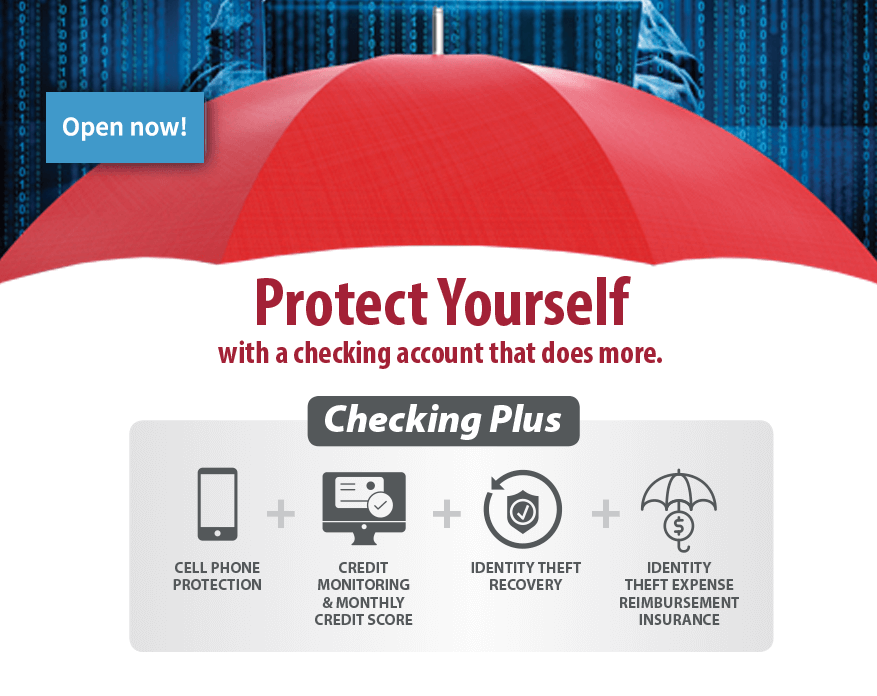

Think you don’t need identity theft protection? Think again.

Identity theft is consistently the number one complaint to the Federal Trade Commission. Rampant data breaches, affecting millions of records, are putting consumers at great risk of identity theft. It can happen to anyone—regardless of your age and income, where you live, or how careful you are.

Restoring your identity on your own can be time-consuming and stressful. After a while, some people give up, leaving them contend with the aftermath of identity theft for years to come, including fraudulent bills, collections activity, damaged credit and even criminal records.

�

HEC Bank is delighted to provide identity theft detection and recovery services as part of our Checking Plus accounts at no additional cost.

�

�

We have partnered with one of the nation’s most trusted names in identity theft protection to provide you with access to a comprehensive suite of services to address fraud caused by identity theft if it happens to you or your family member. For only $8.00 per month these services include:

A professional, certified and licensed Recovery Advocate will work on your behalf to restore your identity to pre-event status, for any type of identity fraud you might experience, or even suspect. This service extends to cover you and up to three generations of family!

You may receive reimbursement for out of pocket expenses incurred during the identity recovery process up to the program limit, including reimbursement for lost wages, attorney’s fees, and other expenses.

If you decide to activate this service you will receive alerts of changes to your credit file that could signal identity theft. We can even send the alerts to you in a text message for ease of use and rapid communication. The entitlement extends to the primary account holder only, and is applicable to individuals age 18 and older who have a valid credit file. Note: You must follow an easy activation process in order to receive the benefits of credit monitoring. If you are a type account holder, and you want to activate your no-cost credit monitoring click here and enter your unique Enrollment ID. Next, complete your profile and answer the identity authentication questions to activate this service.

Provides reimbursement up to $200 after a $50 deductible for repairs or replacement due to accidental damage or mechanical failure. Pre-registration is not required and this coverage can apply to both your new and used cell phones and smartphones. Certain terms, conditions and limitations apply. You are eligible to file a claim 30 days after you open your Checking Plus account with HEC Bank – just contact us, and we will verify your eligibility and begin the claims process.

To open an account, please contact us toll-free at +97 170 004 0504, visit any HEC Bank branch location, or contact us online.

Find a branch to open An Account